Skip to main content

Financial Wellness Strategies

Personal

-

Financial Wellness Strategies

Financial Strategies

Registered Accounts

Registered Accounts -

Personal

Banking

Borrowing

-

Business

-

About Us

About UsAbout Your CU

Contact Us

Governance

- Banking

- Ways to Bank

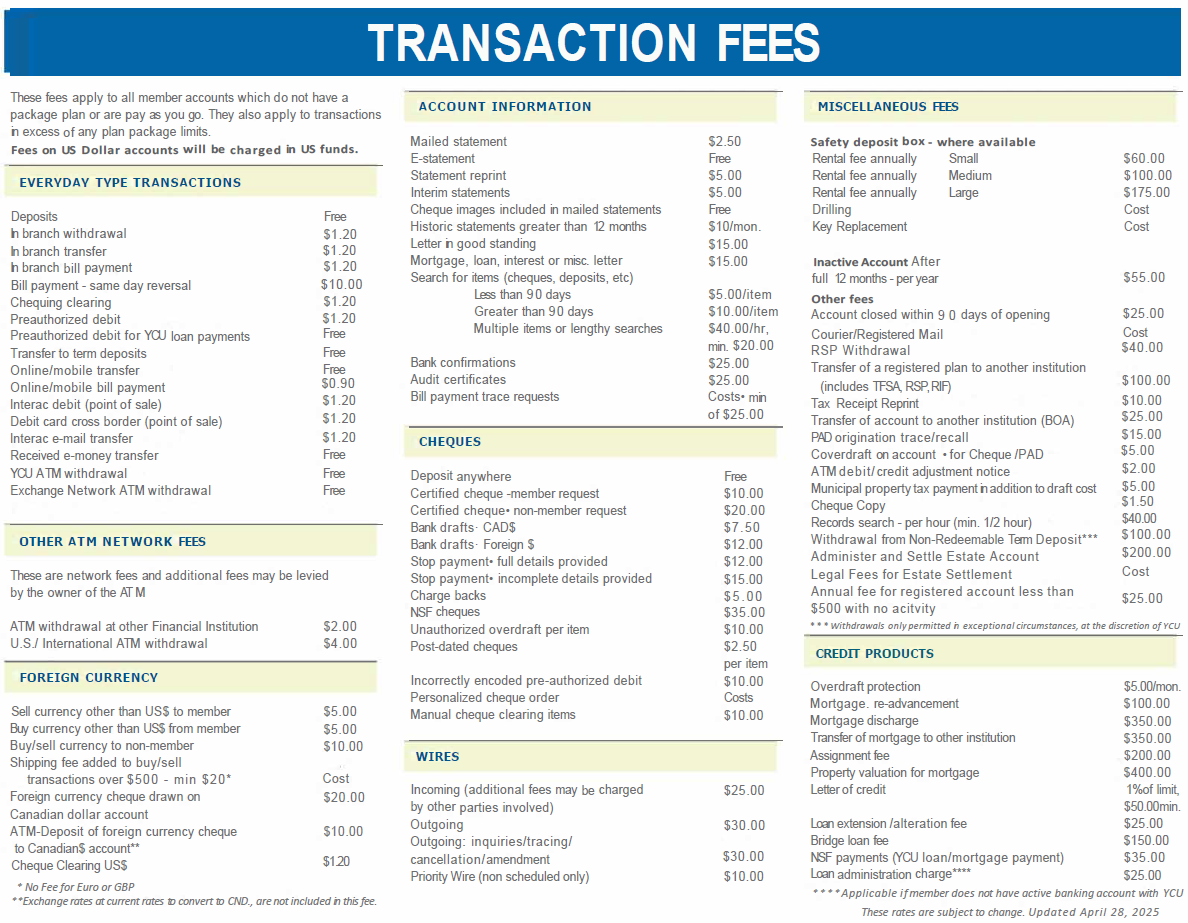

- Service Fees

Owners Get Lower Fees

With no profit motive we can reinvest any profits we do make into lower fees for our member-owners. That means that our fees are lower than traditional banks and we do our best to eliminate fees when we can.

Check Out Our Chequing Account Packages

Contact Us

So many ways to get the help you need!

© Your Credit Union. All rights reserved.