Bank Investigator Scam

Skip to main content

Financial Wellness Strategies

Personal

-

Financial Wellness Strategies

Financial Strategies

Registered Accounts

Registered Accounts -

Personal

Banking

Borrowing

-

Business

-

About Us

About UsAbout Your CU

Contact Us

Governance

- Banking

- Blogs

Blogs

Advice From the People You Trust

We understand what it’s like for busy moms who are managing a household and juggling many different priorities...

Financial literacy is just like language literacy; we all have it to some level. If you can speak and read and express...

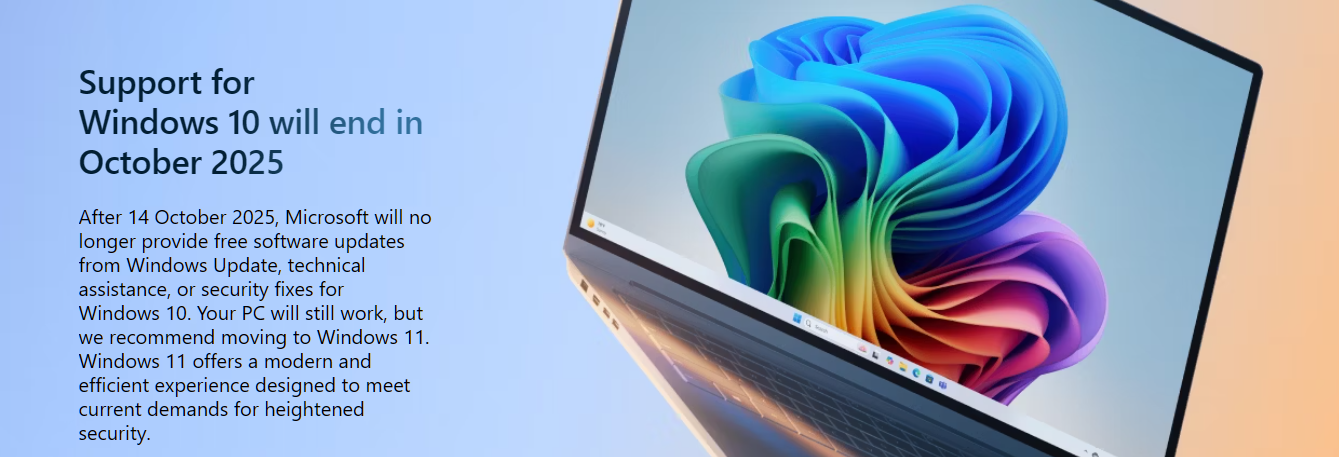

Microsoft will stop supporting Windows 10 Home, Windows 10 Pro, and Windows 10 Education on October 14, 2025.

Unfortunately, fraud is a serious issue in today’s world. The Internet has provided amazing opportunities but it has also increase...

Ahh Christmas… that magical time of year when the average North American family racks up...

It’s the time of year when we clean out the gardens, the garage and the gutters but it’s also a good time to take a look at your finances...

If this is you, you are not alone. However, taxes are one of only two things which are certain...

Most people these days maintain their schedule on a digital calendar that they share between their computer, their mobile phone and perhaps a tablet. The key to making the holidays manageable...

While malls are kind of dead these days, the urge to spend money on stuff is still very much alive. When you see something you want...

Most people believe they should be saving money, but may not know how to make that money earn more money. A piggy bank...

A University of Cambridge study found that money habits in children are formed by the time they are seven years old...

We all know that credit cards can be a valuable weapon in your spending arsenal. They can help you build good credit...

You likely did not start an emergency fund in anticipation of a global pandemic, but it has certainly demonstrated the importance of putting money aside for...

Contact Us

So many ways to get the help you need!

© Your Credit Union. All rights reserved.

.jpg)